By Danny Chan

“Is your income protected?” Ask that of most working Australians and you’re likely to draw a blank face. As an insurance policy that covers one of our most critical assets, income protection has been grossly underrated and neglected in this country. However, the general indifference – or incredulity – towards income protection often stems from a lack of exposure, rather than interest.

That is precisely why insurance brokers like Wen Wang have been offering free, no-obligation consultations on this important yet under-informed subject.

“When someone who has Income Protection loses his ability to work due to sickness or injury, this person can claim monthly payments of up to 75% of his gross earned income,” he explains.

“Quite simply, it will help put food on the table, petrol in the tank, stop the bank from foreclosing on your mortgage, keep school fees paid and generally give you the means to maintain a reasonable standard of living if you are not able to earn your income.”

Debunking the myths

As owner and Managing Director of Professional & Reliable Financial Services (PRFS), a Sydney-based licensed insurance broker firm that offers specialized financial services for personal and business insurance, Wen is an experienced broker who keenly understands prevailing misconceptions about Income Protection.

According to Wen, many people cling to government social security payments and private health insurance as safety blankets, without realising that these income support schemes, though well intentioned and necessary, have inherent limitations.

Offering a modest level of income support subject to means and asset testing, Wen says government social security payments can only help to a certain degree.

“When your savings are depleted due to a loss in income, social security can ill afford to maintain your current lifestyle.”

Similarly, although private health insurance takes care of hospital stays and medical bills, they do not cover out-of-pocket medical expenses or rehabilitation costs. It most certainly will not cover home and car loan repayments and other expenses that constitute your current costs of living.

“When your income is being compromised, then Income Protection would be the single most important cover in guarding against that loss; not health insurance or social security, simply because they were not designed for that purpose.”

“Other than Income Protection, no other insurance policy or government welfare package could pay you a monthly benefit of up to 75% of your income to replace your lost earnings.”

To those who find relief from having insurance through their superannuation funds, he warns: “The average lump sum insured amount is paltry compared to estimated insurance needs, and the difference is just staggering.”

Worker’s compensation is next on the list of inadequate covers for income loss. For self-employed dentists, it pays to be aware that sole traders and partnerships are not eligible for worker’s compensation. Statistics show that more than 50% of all serious accidents occur outside the workplace where such compensation does not apply, nor does it cover non-work related illnesses.

More affordable than you think

Perhaps the biggest misconception regarding Income Protection involves the cost of investing in one. Unbeknownst to many, it may even cost you less to insure your income – quite possibly your biggest asset – than your car. All you have to do is weigh actual costs against benefits to realize that Income Protection is not only inexpensive but also affordable for most people.

For example: John, 35-year-old dentist, non-smoker, healthy, currently draws an annual income of $200,000. John takes up an Income Protection policy with waiting period 30 days, benefit period of up to age 65, and monthly benefit of $12,500.

With this policy, if John is unable to generate income due to any illness or injury, the insurance company has to pay him $12,500 every month until he is able to work again. If he is unable to work permanently, insurance company has to pay the same amount (increased with CPI every year) until he is 65 years old.

John’s premium is just $35.84 per week, which is also tax-deductible. That means around 46 per cent of the premium can be claimed through tax deductions.

Getting professional help saves on premiums

With a plethora of income protection polices available on the market, it does help to engage a professional insurance advisor like Wen to sift through the clutter of information; and provide timely analysis of the various plans and insurance companies that offer them – especially when consultation is free-of-charge.

Professional & Reliable Financial Services (PRFS) does not charge any consultation fees but instead, earns commission from the insurance companies. The Sydneysider stresses that a client who signs up a policy through him pays the exact same premium, as that charged by the insurance company. The difference is that Wen helps the client design a suitable insurance policy that considers critical factors such as: Duration of waiting period; fixed/variable premium; agreed value policy/ indemnity policy; combination of fixed/unfixed premium; insured sum calculation etc. Also noteworthy is that a well-designed insurance policy will save on premiums and make the claim easier. In addition to conducting regular policy reviews with the client, Wen draws on extensive market research, to determine the products that offer the best features at the lowest premiums.

Incidentally, that is the type of information that direct representatives of insurance companies and banks will not be giving you.

Wen Wang’s brief bio:

Since embarking on a milestone career change in 1999, from university-based researcher to insurance adviser, Wen has not looked back. The Master’s Degree holder in Biotechnology from the University of New South Wales became both the youngest supervisor as well as unit manager in his firm. Not contented with consistent results and a steady rise through the ranks, Wen dedicated a year to obtain the Australian Financial Services License and finally set up Professional & Reliable Financial Services (PRFS) in 2007. A professional insurance broker with 10 years experience, Wen’s specialty is in designing insurance policies. PRFS provides a broad range of personal and business insurance services.

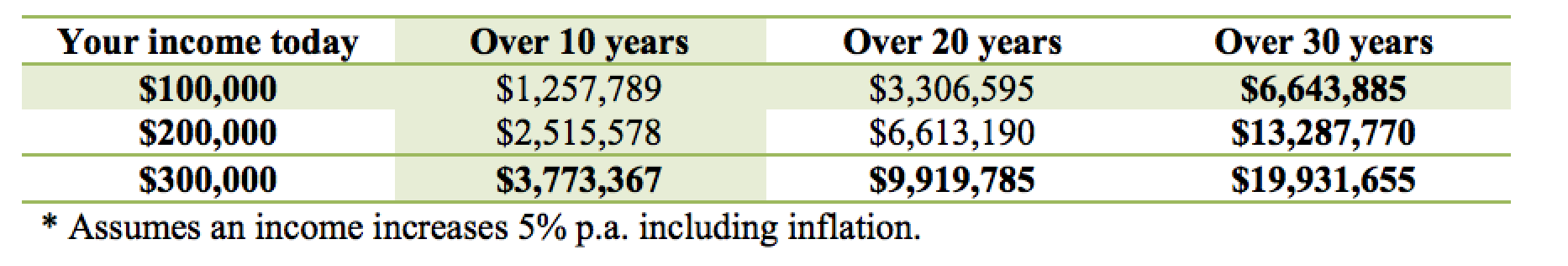

Table 1:

Do you know how much your total income may amount to, over the next 10, 20 and 30 years?

Facts to ponder over:

- A stroke occurs every 11 minutes in Australia

- Every working Australian has a 1 in 3 chance of becoming disabled for more than 3 months before turning age 65

- Males have a 2-in-5 chance of suffering a critical illness between age 30 and 64, while femails have a 1 in 4 chance.

RSS Feed

RSS Feed